(Key Highlights) Union Budget 2023-24

Union Budget 2023-24

The budget for FY24 continued with the government's vision of complementing the macro-economic level growth focus with a micro-economic and all-inclusive welfare emphasis. The government had been facing a tough choice to provide a spending push in a slowing global environment without compromising fiscal prudence and stoking inflationary impulses.

While it is usually difficult to achieve all the objectives at one go, the budget managed to do so. There is high focus on capital spending, deft fiscal management while ensuring duration supply is moderate, thus creating enabling conditions for sustained economic growth without aggravating inflationary pressure.

Key highlights of the Budget are as follows

Seven priorities of the budget are complementing each other and act as the 'Saptarishi' guiding through the Amrit Kaal, include Inclusive Development, Reaching the Last Mile, Infrastructure and Investment, Unleashing the Potential, Green Growth, Youth Power and Financial Sector.

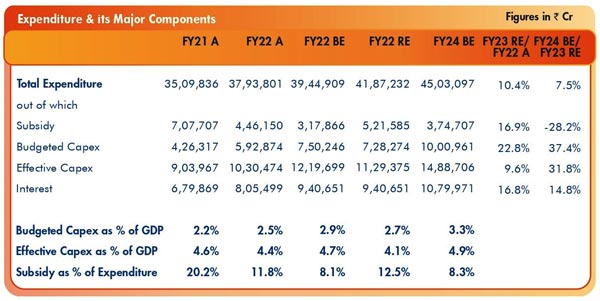

- Effective Capital Expenditure of Centre is pegged at INR 13.7 lakh crore for 2023-24.

- Capital outlay of INR 2.40 lakh crore has been provided for the Railways, which is the highest ever outlay and about 9 times the outlay made in 2013-14.

- Outlay for PM Awas Yojana is being enhanced by 66% to over INR 79,000 crore for 2023-24.

- INR 20 lakh crore agricultural credit targeted at animal husbandry, dairy and fisheries.

- Agriculture Accelerator Fund to be set up to encourage agri-startups by young entrepreneurs in rural areas.

- INR 35,000 crore outlay for energy security, energy transition and net zero objectives.

- Revamped credit guarantee scheme for Micro, Small and Medium Enterprises (MSMEs) through infusion of INR 9,000 crore in the corpus.

Fiscal Policy Estimates 2023-24

- The total receipts other than borrowings and total expenditure are estimated at INR 27.2 lakh crore and at INR 45 lakh crore respectively.

- The net tax receipts are estimated at INR 23.3 lakh crore.

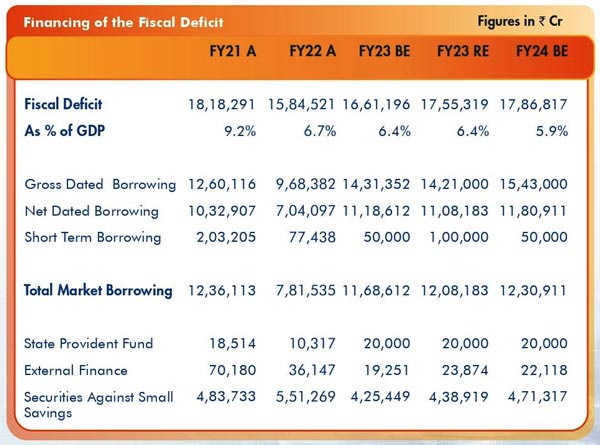

- The Fiscal Deficit is estimated to be 5.9% of GDP for 2023-24. The net market borrowings from dated securities are estimated at INR 11.8 lakh crore and the gross market borrowings are estimated at INR 15.4 lakh crore.

- Targeted Fiscal Deficit to be below 4.5% by 2025-26.

Specific Proposals

- Cash transfer of INR 2.2 lakh crore to over 11.4 crore farmers under PM Kisan Samman Nidhi.

- Mahila Samman Bachat Patras to be launched, offering deposit facility of up to INR 2 lakh in the name of women or girls for the tenure of 2 years.

- Tax structure in new personal income tax regime changed by reducing the number of slabs to five and increasing the tax exemption limit to INR 3 lakh.

- Rebate limit of Personal Income Tax to be increased to INR 7 lakh from the current INR 5 lakh in the new tax regime.

- The maximum deposit limit for Senior Citizen Savings Scheme to be enhanced from INR 15 lakh to INR 30 lakh.

Source & Courtesy: Union Budget 2023-24

data-matched-content-ui-type="image_card_stacked"

Useful Tips & Articles

तैयारी कैसे करें? |

EXAM SUBJECTS |

STUDY RESOURCESDownload Free eBooks |